Larsen & Toubro Limited (L&T)

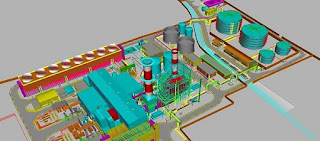

said that it has successfully commissioned and handed over the 360 MW

state-of-the-art Bheramara Combined Cycle Power Plant Project to North West

Power Generation Company Limited (NWPGCL), the wholly owned subsidiary of Bangladesh Power

Development Board, on Jan 5, 2018.

Larsen & Toubro Limited is India's largest

engineering & Construction Company generating 48 percent revenue from

infrastructure in FY17. The company

generated 34 percent revenue from international markets in the fiscal

2017. The company’s order book was Rs.

2.57 lakh crore as of the second quarter FY2018.

Shares of Larsen & Toubro Limited is

currently trading at Rs. 1,332.40, down by Rs. 5.85 or 0.44% on the NSE, at

15:00 hours of trade.